In 2018, 1.7 billion adults worldwide, nearly 1 adult out of 3, still live without basic financial transaction accounts.

In 2018, 1.7 billion adults worldwide, nearly 1 adult out of 3, still live without basic financial transaction accounts.

For the 1.2 billion people who did open financial accounts between 2011 and 2018, the problem is that many do not actively use their account. For example, in India’s initiative of financial inclusion in the early 2010s, nearly 90percent of the 100 million accounts opened are dormant, unused, or closed.

These are some of the daunting statistics that pose key challenges for universal financial inclusion by 2020 set by the World Bank. The goal is clear: getting people to open and maintain financial accounts.

Why Financial Inclusion?

Before discussing the mechanics of reaching universal financial inclusion, particularly for impoverished people in developing countries, why the push for financial inclusion at all?

The World Bank has released several studies that closely link poverty reduction, economic growth, and access to digital or physical financial services. In particular, for developing countries, empowering small farmers, merchants, and villages through financial stability and services can significantly improve their livelihood and economic security.

Additionally, financial inclusion, particularly through less formal means such as through microfinance or rotating savings and credit associations, has a key role in reducing social inequality for rural, poorer populations and women in developing countries.

What Are The Solutions?

Particularly in Southeast Asian countries, such as Indonesia and the Philippines, digital solutions to financial inclusion prove most successful. For example, a financial company in the Philippines, PayMaya, has opened doors to people across the country to allow new, emerging payment methods using QR codes. WeChat pay have partnered with a variety of businesses and mom-and-pop styled stores.

This strategy has worked, in part, due to the prevalence of smartphones in Philippines. The number of mobile phone users in the Philippines reached 74.2 million (out of a population 108.2 million), around 70 percent of the country’s population. PayMaya has also utilized the network of local vendors and merchants in the Philippines, which makes their service convenient and credible to impoverished populations who trust local merchants they have been going to for years.

Success in Indonesia

Indonesia is another success story of digital financial inclusion. For example, by making their G2P programs digital, welfare recipients receive payments directly to their digital accounts, which demonstrates the power that technology can have in reducing transaction costs and increasing convenience for those in need. Indonesia also has the regulatory framework to house a thriving banking industry and network of mobile operators. Indonesia has identified that 119 million adults are still excluded from financial services, but that, 100 million out of the 119 are smartphone users. So, the continued path forward for financial inclusion in Indonesia will be increased digitization of financial services.

What Is The Future of Financial Inclusion?

The examples of Indonesia and the Philippines shed light on broader discussions about financial inclusion from governmental organizations like the World Bank and companies like the International Finance Corporation. The success of Indonesia’s and the Philippines’ financial inclusion depends on lowering regulatory barriers, making financial options attractive and convenient, especially to poorer populations, and establishing strong social networks throughout the country.

Significant Barriers

These are exactly the barriers to reaching the last 1.7 billion excluded people, who are predominantly in developing countries. These populations often do not have enough money to open a bank account, lack the financial literacy to maintain a bank account, or simply do not trust brick and mortar institutions that do not have particular incentives to penetrate rural markets. Less formal means, such as microfinance or rotating savings and credit associations (ROSCAs), are more attractive because these systems pool money between trusted individuals, often friends or family, and allow people to save and borrow smaller amounts of funds that would not be enough to open a bank account.

World Bank Efforts

The World Bank has targeted several categories to develop over the coming years, such as creating a regulatory environment to enable access to transaction accounts, drive government-based solutions and programs for transaction accounts, focus on the disadvantaged, such as rural families and women, and digitize payments. The World Bank has identified 25 priority countries where nearly 70 percent of all financially excluded people live worldwide and are on track to reach 1 billion opened accounts by 2020.

From a corporate standpoint, PayMaya shows that financial inclusion offers a new, emerging market for financial and fintech companies, who have an economic incentive and profit motive for tapping into developing countries and helping to improve access to financial services. Digital finance has the potential to reach over 1.6 billion new retail customers in developing countries, with potential profits from the aggregate market estimated to be an astounding $4.2 trillion.

With both political will and economic incentive, the way forward seems clear: invest in digital solutions that partner with local networks and that work to tailor to the preferences of poorer populations, who may have low financial literacy and may mistrust large, corporate institutions.

– Luke Kwong

Photo: Flickr

Understanding the Water Shortage in Chennai

Why Access to Water Matters

Water is an integral part of everyday life in Chennai. At least 85 percent of the area is directly dependent on rain to recharge its groundwater. Agriculture is a big part of Chennai’s ecosystem and economy. Rain provides water for irrigation and livestock. Healthy living is another result of easy access to clean water. Rain provides water for drinking, cooking, cleaning and other household needs.

Rainfall is collected, stored and treated in four main reservoirs: Chembarambakkam Lake, Redhills Lake, Poondi Lake and Cholavaram Lake. These bodies of water depend on seasonal rainfall to replenish water levels year after year. At capacity, Chembarmbakkam holds 3,645 million cubic feet (MCFT) of water, Redhills holds 3,330 MCFT, Poondi holds 3,231 MCFT and Cholavarm holds 1,081 MCFT.

Recent records show that combined, all four reservoirs are at 1.3 percent of total capacity. In May 2019, Chembarambakkam only held one MCFT of water, Redhills held 28 MCFT, Poondi held 118 MCFT and Cholavarm held four MCFT. The water shortage is impeding the city’s ability to produce food, creating severe food insecurity and exposing its residents to unsanitary living conditions.

Factors Driving Chennai’s Water Shortage

Various factors are contributing to the water shortage in Chennai. The most observable factor is the lack of rain. Typically, India’s monsoon rain season occurs between June and September. Similar to a hurricane or typhoon, monsoons bring torrential rains across India which replenish the region’s water supply. For the past couple of years, Chennai has experienced lower than normal rainfall. Even monsoon rain levels were recorded to be 44 percent lower than the average in June 2019.

Lower rainfall, combined with scorching temperatures, has created drought-like conditions in the area. To make matters worse, Chennai continues to grow water-guzzling crops like sugarcane, rice and wheat. With no improvements in sight, some Chennai residents have chosen to migrate out of the area to avoid the consequences of the impending water shortage.

Response to the Water Shortage in Chennai

City officials and residents are responding to Chennai’s water shortage and drought. Here are three ways Chennai is increasing and conserving its water levels:

The Chennai Metropolitan Water Supply and Sewerage Board continues to monitor India’s water situation.

– Paola Nuñez

Photo: Flickr

7 Facts About Poverty in Gaza

7 Facts about Poverty in Gaza

Hamas has governed the Gaza Strip since it orchestrated a coup d’état in 2007 Both the United States and the European Union label Hamas as a terrorist organization, This is due to its explicit acts of violence against Israel and its citizens. Meanwhile, the Hamas government has developed robust social and welfare programs in the Gaza Strip. Spending is between $50-70 million annually.

The next among these facts about poverty in Gaza is about its blockade. Since Hamas came to power, Israel and Egypt have enforced a land, air and sea blockade of Gaza, citing security concerns. The blockade has contributed to a struggling economy, a lack of clean drinking water, inadequate housing and severe food insecurity. According to the United Nations, “the blockade has undermined the living conditions in the coastal enclave and fragmented… its economic and social fabric.”

In a 2018 report, the World Bank said Gaza’s economy is in “free-fall.” The World Bank cites a combination of factors as the reason for a six percent decline in the territory’s GDP. While the decade-long blockade has done significant damage to the economy, recent cuts to international aid are placing additional strains on Gaza. Another contributing factor is that 52 percent of Gaza’s inhabitants are unemployed. Gaza has a youth unemployment rate of 66 percent.

In fact, 97 percent of Gaza’s freshwater is unsuitable for human consumption. Diarrhea, kidney disease, stunted growth and impaired IQ result from Gaza’s water crisis. Additionally, humanitarian groups warn that Gaza could become uninhabitable by 2020 due to shortages.

In 2018, the U.N. characterized 1.3 million people in the Gaza Strip as food insecure. This constitutes a 9 percent increase from 2014. The blockade prevents many goods from entering the territory. Further, it places strict limits on fishing activity, a major source of economic revenue. It also limits the availability to the equipment needed for construction, as Israel worries the equipment could be used for violence.

Demand for electricity far exceeds the supply. Likewise, the U.N. describes it as a chronic electricity deficit. From providing healthcare to desalinating water, poor access to electricity makes life more difficult in the Gaza Strip.

The United Nations has several arms at work, including the United Nations Relief and Works Agency (UNRWA) and the United Nations Development Programme (UNDP). The UNRWA provides education, health services and financial loans to refugees in the territory. The UNDP targets its assistance to decrease Gaza’s reliance on foreign aid.

Importance of Addressing Poverty in Gaza

These seven facts about poverty in Gaza provide some insight into the situation. However, addressing the region’s poverty proves to be a worthwhile pursuit. Poverty reduction can lead to greater stability. Furthermore, it can increase the chances for dialogue between Israel and Palestine. Overall, international cooperation and foreign aid have the potential to vastly improve the lives of the 1.8 million individuals in Gaza.

– Kyle Linder

Photo: Flickr

The Need for Immunizations: The Truth about Vaccines in Developing Countries

While this is an inspiring fact, the truth is that immunization rates in some developing countries are becoming stagnant.

The Plateau of Immunization Rates

The immunization rates of the vaccine for diphtheria, tetanus and pertussis (DTP) usually reflect the quality of the overall immunization coverage within a nation. In the last three years, the immunization rate for the third dose of DTP in Chad has remained at 55 percent. The immunization rate for DTP in Somalia has been about the same since 2009. Guinea, whose DTP immunization rates used to be around 70-80 percent 10 years ago, now has had a rate of 63 percent for the last four years.

This data is somewhat shocking, considering a global effort to prioritize vaccines began in 2000. The same year, Gavi, a global Vaccine Alliance, was created with the help of a $750 million donation from the Bill & Melinda Gates Foundation. Since 2011, Gavi has surpassed its own goals of decreasing child mortality, averting future deaths and increasing child immunization in the more than 60 countries that are Gavi-supported. In just five years, Gavi was able to provide vaccines to 34 million more children than what was anticipated, and the group began administering vaccines for pneumococcal and rotavirus one year ahead of schedule.

Maintaining the Vaccine Schedule

Nonetheless, groups like Gavi struggle to keep immunization active in developing countries after the child is no longer an infant. For example, the vaccine for human papillomavirus (HPV) is typically administered in two doses within 1-2 years for children above the age of nine. HPV can cause cancer, especially in those with weak immune systems, so it is important to time the vaccine administration effectively in order to be nearly 100 percent protected. Since there is no health plan that puts emphasis on older children, HPV becomes more of a threat in countries that do not enforce the strict vaccine schedule.

The World Health Organization has a plan to fix this. The Global Vaccine Action Plan (GVAP) is set to address health program expansion to include services beyond infancy by 2020. Ministers of Health from 194 countries agreed to support the GVAP, which includes nation-specific health program monitoring and strengthened leadership.

Negative Attitudes About Vaccines

Despite intervention from non-governmental groups, the plateau of immunization rates still exists. This may be due to negative attitudes towards vaccines in developing countries. The attitudes stem from the idea that vaccines are harmful or that the health workers are ingenuine. Citizens of three Nigeran states believed that the administration of the polio vaccine would spread AIDS in 2003, and in India, people believed that vaccines were a Western plot to instigate an undercover method of family planning to threaten Muslims. Researchers cite that a way to eliminate this anxiety is to take into account sociocultural behavior when implementing vaccine programs and to strengthen communication and advocacy in order to increase participation.

While negative attitudes towards vaccines contribute to plateauing immunization rates, the expensive price of vaccines may also be a contributing factor. In 2001, six vaccines from the World Health Organization cost less than $1. Now, 12 vaccines from the WHO cost up to $45.59. This can obtaining a vaccine for someone living in Madagascar extremely difficult – the monthly salary in Madagascar is $33.

Immunizations Eradicate Disease

By increasing immunization rates, diseases can begin to disappear. In the U.S., immunization rates in 2000 were at 91 percent for the measles, mumps and rubella vaccine, and the Center for Disease Control declared measles to be officially eradicated. Since then, diagnoses of measles have increased slightly among populations that are unvaccinated.

Despite these few diagnoses, the majority of the U.S. will never come in contact with measles. Dr. Jean Campaiola, hospital psychiatrist, describes this result as “herd immunity.” Herd immunity occurs when a certain percentage of the population receives the vaccine for a particular disease. For some diseases like measles, the percentage is at least 90-95, but for polio, the percentage is 80-85. This means that 20 percent of people could deny receiving the polio vaccine and still be protected from the disease because the remaining 80 percent were vaccinated.

“If this occurs rarely in a population, it’s not a big deal, but if it becomes more common, then previously eradicated diseases could make their way back into the general population,” says Dr. Campaiola. She said fears that the anti-vaccine attitude in the U.S. could cause previously eradicated diseases to re-emerge.

By administering more vaccines in developing countries, an entire community can be protected by herd immunity. Those most vulnerable to diseases (infants and the elderly) can be immune to certain diseases if more people around them receive vaccines.

In third world countries, governments spend $29 for each person’s health. In the U.S., the government spends $4,499. There is a clear need for vaccines in developing countries around the world, including a larger-scale project to improve coverage. Gavi’s next step in revolutionizing immunization is a five-year program to introduce sustainable health programs in low-income countries and to increase equitable use of vaccines. The U.S. has the power to spread the good message of vaccines, and someday, we can eradicate most major diseases all around the world.

– Katherine Desrosiers

Photo: Wikimedia

Beca 18: An Educational Program that Brings Hope

Lack of educational opportunity is one of the principal reasons why people may get stuck in the cycle of poverty. In many places, people are at least required to have a high-school level of education to get a minimum wage job. Most high-paying positions, however, expect people to have a college degree education, something that for many low-income Peruvians, is very hard to obtain.

In the year 2015, Peru ranked 64 out of 70 on the International Programme for Student Assessments: A standardized test that measures student’s performance on academics. The problems don’t lie within the lack of teachers or a good infrastructure; it lies within the fact that most Peruvians don’t have access to a decent education. Most of the most competitive schools and colleges are in major cities, and with usually high tuition costs.

This difference is prevalent in the countryside where some children have to walk for hours to go to school. In the Peruvian Andes, children are less likely to go beyond high-school education and much less pursue a college degree. As of the year 2017, only 16 percent of young adults were pursuing a college degree, principally because of the inability to pay the high tuition. Fortunately, a governmental program called Beca 18 (Scholarship 18) may soon change that.

The Story of Beca 18

Beca 18 is not the first program that has given scholarships to well-deserved students. The National Institute of Scholarships and Educational Loans, was founded in 1972 and lasted until 2007. While they did offer necessary scholarships and loan payments, they only centered in Lima. After 2007, the new Office of Scholarships and Educational Loan opened, with a more polished selection of students and with a clear focus on trying to reach scholars located on problematic areas of the country, but by all merit have achieved academic excellence.

The Office of Scholarships and Educational Loan worked until 2012, the year on which the former president Ollanta Humala “upgraded” it, becoming the National Program of Scholarships and Educational Loans, also known as Beca 18. The program works as an administrative unit of the Peruvian Ministry of Education with 24 regional offices, giving around 52 236 scholarships around 25 regions from 2012 to 2016. Most of the students that benefited were living in extreme poverty.

How the Program Works

The first thing that applicants have to know is if they meet all the appropriate requirements. For Beca 18, a student’s living conditions have to be below the poverty line, attending the last year of high school or have recently graduated and been on the honor roll. The Scholarship has other ramifications that cater to different students, like Beca Albergue, that centers around students that lived in foster care.

After meeting the requirements, the next step is applying to the National Exam, which can be done by just accessing the scholarships webpage during the call-up time, that happens around December each year. Each student needs to present their essential legal documentation; however, depending on what portion of Beca 18 the student is interested in they may submit additional paperwork. After taking the exam, hosted by many public and private schools around the country, each student receives guidance to get into their desired college. Once accepted, the process of applying for the Scholarship can begin, only students with satisfactory grades on both the National Exam and their college entrance exam, are granted the scholarships.

What Costs Are Covered

Depending on each of the holder’s family and economic situations, the scholarships cover the costs of the admissions exam, full tuition and other work materials, such as a laptop. If needed, the awards include accommodations, transportation, and pocket money. A private tutor is also an option but only for public universities, as privates often offer that service to its students. These, of course, help students that either came from the Andean of Rainforest Regions of the country or lived in an extreme poverty situation.

Famous Recipients

As mentioned before, Beca 18 is an excellent opportunity for many people that couldn’t afford higher education but had exceptional academic abilities. Like Omar Quispe, a recipient that now is a developer for ElectroPeru. He is currently working on a project that could bring good quality electricity to his native Huaylas, a district surrounded by extreme poverty. Another famous case is of Abel Rojas Pozo, that upon graduation started to help local guinea pig farmers spend their business. These efforts were to make his hometown one of the centers of guinea pig exports.

With an educated population, the chances of escaping poverty are higher. And like the recipients of Beca 18, they can use their new-found knowledge to help their families and their communities.

– Adriana Ruiz

Photo: Wapa

Helping Syrian Refugees After Arrival

The Syrian refugee crisis has been ongoing for more than eight years since the civil war that started in 2011. More than 5 million people have fled Syria, while many more were displaced within Syria itself. Externally, Lebanon, Turkey and Jordan have the highest proportion of Syrian refugees in the world. Since refugees often try to live in urban areas for better employment opportunities, they frequently struggle with financial resources and end up living below the poverty line. In response, domestic and international organizations are helping Syrian refugees after arriving in each of these three countries.

Lebanon

As of June 30, 2016, Lebanon had the most Syrian refugees relative to its population, which was about 173 refugees per 1,000 people, or a total of 1,035,700. Lebanon also hosts a high number of refugees compared to its GDP, equating to 20 refugees per $1 million in GDP. While Lebanon hosts a large number of refugees, it is struggling to provide for them. There are around a million Syrian refugees in Lebanon, 70 percent of whom live below the poverty line. These refugees often have little to no financial resources, which leads them to live in crowded homes with other families in more than 2,100 communities.

One organization helping Syrian refugees in the country is the Lebanese Association for Development and Communication (LADC), which emerged to help both Palestinian and Syrian refugees. Its projects range from community-based projects to aid projects with both local and more than 500 international volunteers helping to establish more than 6,500 beneficiaries. One of its projects was the Paradise Wall, a community art project to smooth the integration process between 120 Syrian and Lebanese children by asking them to work together creatively to produce a wall full of designs.

Turkey

Turkey hosts the largest number of registered Syrian refugees – currently at 3.3 million. Authorities claim that there are more than 3 million Syrian refugees, but that they have not registered. This is because they see Turkey as a transit country or fear deportation. The fear of deportation comes from the fact that Turkey offers temporary protection status to Syrians instead of internationally-recognized refugee status. This increases the likelihood of Turkey deporting the refugees while avoiding the risk of receiving international renouncement for doing so. Most refugees attempt to settle in urban areas in these countries, as opposed to refugee camps where only 8 percent of registered Syrian refugees live.

In Turkey, the UNCHR, EU and WHO have come together to fund the Association for Solidarity with Asylum Seekers and Migrants (ASAM), which is a multi-regional organization that does a wide variety of work to help Syrian refugees after arriving in Turkey. It has many projects ranging from legal counseling to psycho-social support for children through playful activities. One of its projects titled Women and Girls’ Safe Space emerged to offer training sessions on women’s reproductive health.

Jordan

Jordan is proportionally the second-largest host of the Syrian refugees, sheltering about 89 refugees per 1,000 inhabitants as of 2016. Fifty-one percent of these refugees are children and 4 percent are elderly, meaning that 55 percent are dependents who rely on the remaining 45 percent of adult, working-age Syrian refugees. Consequently, more than 80 percent of them live under the poverty line.

To deal with this, the Jordanian government has initialized formal processes to help them escape poverty. In 2017 alone, the country issued 46,000 work permits so that Syrian refugees work. Recently, in collaboration with UNHCR, the International Labor Organization (ILO) established an employment center, The Zaatari Office of Employment, in the biggest camp for Syrian refugees. By August 2017, around 800 refugees benefited from this center by registering official work permits in place of one-month leave permits.

While the Syrian refugee crisis is still ongoing, it is important to note that many are helping Syrian refugees to settle and integrate into their host societies. Many countries from all over the world are starting to resettle the refugees within their borders to lift off the burden of poverty and overcrowding in certain areas. People often recognize Lebanon, Jordan and Turkey for their willingness to take in large numbers of Syrian refugees, but this must not erase the work a variety of organizations are doing to help refugees after arriving in their new homes.

– Nergis Sefer

Photo: Flickr

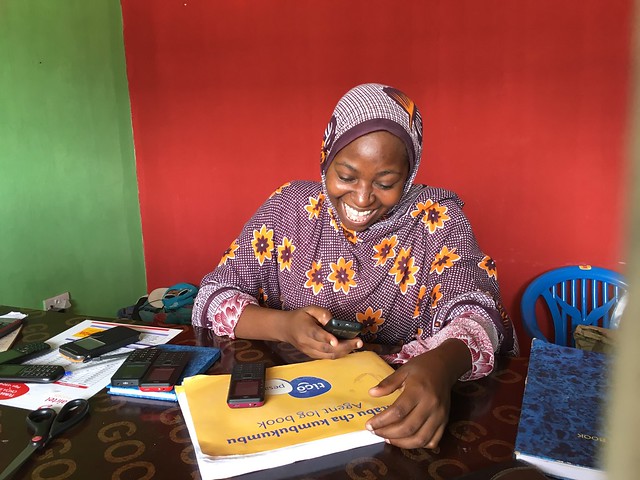

Financial Inclusion Through Technology

For the 1.2 billion people who did open financial accounts between 2011 and 2018, the problem is that many do not actively use their account. For example, in India’s initiative of financial inclusion in the early 2010s, nearly 90percent of the 100 million accounts opened are dormant, unused, or closed.

These are some of the daunting statistics that pose key challenges for universal financial inclusion by 2020 set by the World Bank. The goal is clear: getting people to open and maintain financial accounts.

Why Financial Inclusion?

Before discussing the mechanics of reaching universal financial inclusion, particularly for impoverished people in developing countries, why the push for financial inclusion at all?

The World Bank has released several studies that closely link poverty reduction, economic growth, and access to digital or physical financial services. In particular, for developing countries, empowering small farmers, merchants, and villages through financial stability and services can significantly improve their livelihood and economic security.

Additionally, financial inclusion, particularly through less formal means such as through microfinance or rotating savings and credit associations, has a key role in reducing social inequality for rural, poorer populations and women in developing countries.

What Are The Solutions?

Particularly in Southeast Asian countries, such as Indonesia and the Philippines, digital solutions to financial inclusion prove most successful. For example, a financial company in the Philippines, PayMaya, has opened doors to people across the country to allow new, emerging payment methods using QR codes. WeChat pay have partnered with a variety of businesses and mom-and-pop styled stores.

This strategy has worked, in part, due to the prevalence of smartphones in Philippines. The number of mobile phone users in the Philippines reached 74.2 million (out of a population 108.2 million), around 70 percent of the country’s population. PayMaya has also utilized the network of local vendors and merchants in the Philippines, which makes their service convenient and credible to impoverished populations who trust local merchants they have been going to for years.

Success in Indonesia

Indonesia is another success story of digital financial inclusion. For example, by making their G2P programs digital, welfare recipients receive payments directly to their digital accounts, which demonstrates the power that technology can have in reducing transaction costs and increasing convenience for those in need. Indonesia also has the regulatory framework to house a thriving banking industry and network of mobile operators. Indonesia has identified that 119 million adults are still excluded from financial services, but that, 100 million out of the 119 are smartphone users. So, the continued path forward for financial inclusion in Indonesia will be increased digitization of financial services.

What Is The Future of Financial Inclusion?

The examples of Indonesia and the Philippines shed light on broader discussions about financial inclusion from governmental organizations like the World Bank and companies like the International Finance Corporation. The success of Indonesia’s and the Philippines’ financial inclusion depends on lowering regulatory barriers, making financial options attractive and convenient, especially to poorer populations, and establishing strong social networks throughout the country.

Significant Barriers

These are exactly the barriers to reaching the last 1.7 billion excluded people, who are predominantly in developing countries. These populations often do not have enough money to open a bank account, lack the financial literacy to maintain a bank account, or simply do not trust brick and mortar institutions that do not have particular incentives to penetrate rural markets. Less formal means, such as microfinance or rotating savings and credit associations (ROSCAs), are more attractive because these systems pool money between trusted individuals, often friends or family, and allow people to save and borrow smaller amounts of funds that would not be enough to open a bank account.

World Bank Efforts

The World Bank has targeted several categories to develop over the coming years, such as creating a regulatory environment to enable access to transaction accounts, drive government-based solutions and programs for transaction accounts, focus on the disadvantaged, such as rural families and women, and digitize payments. The World Bank has identified 25 priority countries where nearly 70 percent of all financially excluded people live worldwide and are on track to reach 1 billion opened accounts by 2020.

From a corporate standpoint, PayMaya shows that financial inclusion offers a new, emerging market for financial and fintech companies, who have an economic incentive and profit motive for tapping into developing countries and helping to improve access to financial services. Digital finance has the potential to reach over 1.6 billion new retail customers in developing countries, with potential profits from the aggregate market estimated to be an astounding $4.2 trillion.

With both political will and economic incentive, the way forward seems clear: invest in digital solutions that partner with local networks and that work to tailor to the preferences of poorer populations, who may have low financial literacy and may mistrust large, corporate institutions.

– Luke Kwong

Photo: Flickr

10 Facts About Child Labor in Mali

Mali, the eighth-largest country on the African continent, is home to approximately 18 million individuals, more than half of which are children. Historically, Mali has suffered economically due to excessive conflicts between multiple military coups and rebel groups. With 67 percent of the population under the age of 25, children have become the most vulnerable in a nation growing with violence and slavery. These 10 facts about child labor in Mali will detail the country’s history of child labor and how it is combatting it.

10 Facts About Child Labor in Mali

Mali continues to struggle as one of the world’s poorest nations. These 10 facts about child labor in Mali illustrate how extreme poverty has driven slavery within the nation. Despite numerous failed attempts to control child labor, Mali has seen some advancement in recent years.

– Danyella Wilder

Photo: Flickr

How Poverty Enforces Patriarchy Worldwide

While poverty and patriarchy may seem like separate issues, the two connect deeply. As long as poverty exists, women’s rights and livelihoods will suffer. Likewise, women’s oppression leads to their inability to contribute to the economy and prevents a family’s escape from cycles of poverty. Here are some examples from around the world of poverty and patriarchy reinforcing each other, and some ways humanitarian aid can improve these situations.

Microcredit in Bangladesh Has Left Millions of Women At High Risk For Domestic Violence

From the 1980s to the mid-2000s, people thought that micro-loans would be the future of international development. In Bangladesh, most of these loans went to women on the belief that women could handle money more responsibly than their male counterparts. They received a small amount of money to invest in materials to start a business and earn an independent livelihood in order to bring their families financial stability. Unfortunately, when these women were unsuccessful at lifting their families out of poverty and their families plunged into greater debt as a result of the loans, they often suffered spousal abuse. For other women, as soon as they received the money, the men and their families took it and used it, leaving them to pay off the loans by themselves. As a whole, micro-credit has not had the intended impact on the people of Bangladesh that the international community once hoped for, and rates of violence against women have climbed, increasing the correlation between poverty and patriarchy

Solution: Investing in women’s education will provide them with the knowledge they need to become financially independent and ensure greater legal protection for victims of domestic violence could greatly combat this issue.

Poverty As a Weapon Against Women in the Democratic Republic of the Congo

Sixty-one percent of women living in the Democratic Republic of the Congo live in poverty, compared to only fifty-one percent of men. This is because people have systematically excluded women from peace-building efforts in the country. Because there are no women’s voices at the decision-making table, countries set policies that prioritize men, often at women’s expense. Disturbingly, women’s rights activists in the country are often a target for violence. Many think that those who advocate for women-centered poverty-relief efforts are distracting from larger issues within the country.

Solution: Studies that researchers conducted in the Democratic Republic of the Congo demonstrate that in areas with high levels of poverty, there are high levels of violence against women. Providing food security, as well as funding institutions and organizations to empower women, are important steps in relieving both poverty and oppression in the DRC.

Time Poverty Makes it Nearly Impossible for Indian Women to Contribute to the Economy

In India, the average man works seven hours per day. Although women usually work for nine hours a day, the vast majority of their labor is unpaid housework and childminding. This means that they have little time to earn any outside wages, and therefore, remain financially dependent on the men in their families. The power dynamic that this situation creates is extremely dangerous. Women lose any agency they may have because they depend on their fathers, husbands or brothers for everything. This means that they have no power to go against their male relative’s wills. It also hurts the Indian economy, as women have little ability to contribute to it.

Solution: In rural India, women spend upwards of four hours each day gathering fuel and cleaning utensils to cook with. Providing them with solar or electric cookers could save them three hours of unpaid labor, giving them more time to do what they want to do or contribute to the economy as an untapped workforce.

These examples display just how poverty and patriarchy intertwine and push women and their families into poverty. If women could gain an education, receive food security or use alternative cooking equipment to limit labor, they might be able to improve their situation and lift themselves out of poverty.

– Gillian Buckley

Photo: Wikimedia

10 Facts About Hunger in Algeria

10 Facts About Hunger in Algeria

These 10 facts about hunger in Algeria illustrate that hunger is a problem that the country may overlook. At first glance, the country may appear to be doing well, however, the most impoverished Algerians suffer greatly from food insecurity. Thankfully, the country is making progress in combating this difficult problem, which means there is hope that Algeria will one day eliminate hunger.

– Gaurav Shetty

Photo: Flickr

Updated: July 12, 2024

10 Facts About Life Expectancy in Namibia

Namibia has continued to make large strides in many aspects of life, including life expectancy. Having suffered a history of colonization and oppression, Namibia struggled for years with political, social and cultural issues. However, as the country has begun to strengthen and mingle on a global level, it has and is continuing to make exceptional progress. These 10 facts about life expectancy in Namibia will bring attention to the country’s progress and highlight the necessary changes.

10 Facts About Life Expectancy in Namibia

Some have labeled Namibia one of the most promising countries in Africa because of its increasing social, cultural and economic status. One, however, cannot ignore that there is still a lot of room for progress, especially when looking at the less privileged groups in the country. These 10 facts about life expectancy in Namibia highlight all the good that has taken place and should pose some insight into the future.

– Samira Darwich

Photo: Flickr