Latin America and Mobile Banking

Mobile banking technology may be the latest in services to improve social inclusion in Latin America. Due to the extensive penetration of mobile phones in Latin America, a region where there are more phones than people, mobile banking can be used to promote financial transactions.

Approximately 65 percent of Latin Americans lack access to a banking service, and many are hoping that the ubiquity of cellphones will permit the unbanked to open up a bank account remotely and to send and receive payments and utilize other financial services.

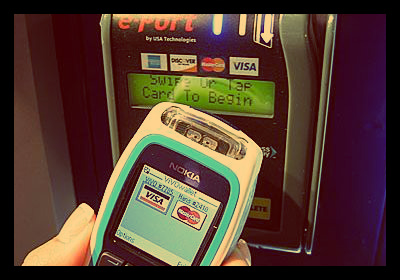

The idea of using a phone as a “mobile wallet” ensures the safety of the money compared to a traditional physical transfer of cash. It also helps the government reduce corruption and waste and improves efficiency and transparency. All governments in Latin America offer citizens Conditional Cash Transfers, a concept that rewards citizens with cash upon the completion of a certain condition, like sending their kids to school or getting vaccinated.

Many countries in South America could reap the benefits of mobile banking technology. In Uruguay, for example, mobile phone penetration is at 132 percent while only 16.9 percent of the population uses a banking service. In Argentina, mobile phone penetration is 142 percent while only 24.4 percent of the population is banked.

Bolivia is leading the trend in mobile banking technology, with 6.8 percent of its population using mobile phones for a banking service, compared to 3.1 percent in Mexico and 1.8 percent in Peru.

The mobile banking service has great opportunity to grow, with just 1.8 percent of the total population using a mobile phone for banking purposes. Mobile phones can be used for more than banking purposes to promote social inclusion, however.

Local businesses can advertise through the use of mobile phones, bringing in more customers and generating more income for the region. Product promotion by businesses could also increase, giving consumers greater access to products. Paying bills would also become more simplified, cutting through red tape that exists in the system and allowing for a more timely delivery and payment of a bill. Moreover, electronic identification removes the necessity of carrying physical identification.

Mobile phone banking in Latin America is a powerful trend that could bring in greater social inclusion if it is harnessed properly. Its convenience allows it to be the catalyst for significantly reducing poverty on the regional level.

– Jeff Meyer

Sources: BN Americas, Banking Technology, WorldBank, Forbes

Photo: Into Mobile