G2Px: Digitizing Government-to-Person Payments

Closing a Digital and Financial Divide

Government payments for retirement, disability, unemployment and basic needs are critical for many households and individuals. However, accessing these benefits is not always straightforward. Payments were traditionally made in cash and required in-person collection, which creates barriers for people living in remote areas, those with limited mobility or individuals who cannot afford to take time off work.

“When there is a payment, we spend the whole day at the town hall, we leave in the morning from our village to come back in the evening and that is a difficulty,” said one Malian cash recipient in a World Bank report. By shifting government-to-person payments to digital platforms, recipients gain incentives to access financial services. This helps close the digital divide, promotes digital literacy and offers more secure financial access.

A Path to Financial Inclusion

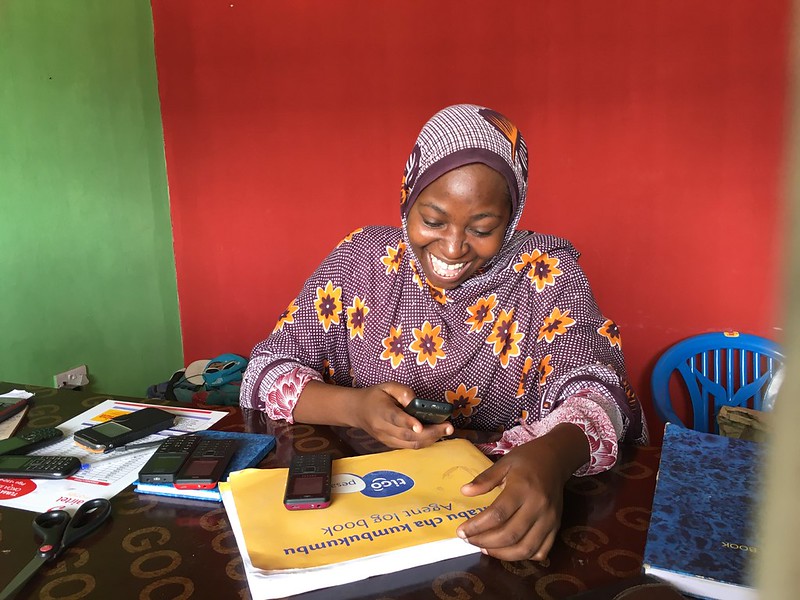

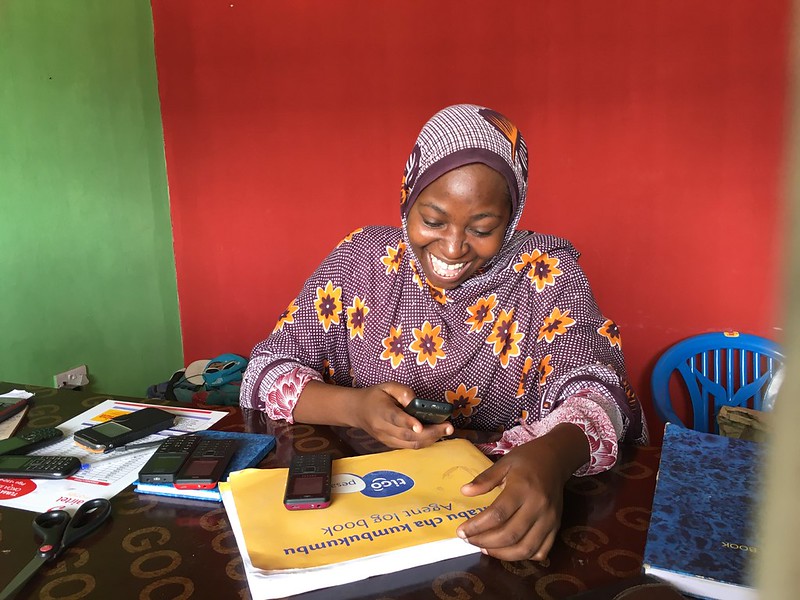

Digital G2P payments can serve as a first step toward broader financial inclusion. For many recipients, especially in low-income or rural areas, receiving government payments through a bank or mobile account is their first interaction with the formal financial system.

According to the World Bank, 865 million account owners in developing countries—including 423 million women—opened their first financial institution account to receive government payments. This initial connection can lead to increased use of financial services such as saving, borrowing or making digital transactions. The impact is particularly significant for women and young people, who often face additional barriers to financial access.

The G2Px Initiative: Progress and Empowerment

Despite progress in digital government-to-person payments, the digital and financial inclusion gap remains, with 1.4 billion adults still unbanked worldwide. To help close this gap, the World Bank Group created the G2Px initiative. In partnership with the Bill & Melinda Gates Foundation and Norad, the initiative supports governments in improving G2P systems through policy development, design improvements and digital and financial literacy programs.

In a 2023 report, the World Bank Group highlighted how G2Px supported data collection that helps modernize G2P payments with recipients at the center. The report documented good practices that countries can adopt, and many nations have since joined the conversation. Sierra Leone launched its first account-based social assistance payments, while Yemen completed a study to inform mobile money pilots in eight districts, with 18,000 recipients already registered to opt in.

Technical assistance from the initiative also supported policies that promote inclusion. Jordan’s National Aid Fund revised program design to enable government-to-person payments to women instead of only heads of households.

This empowerment is one of the key benefits of digitizing G2P payments. Access to digital payments can strengthen women’s privacy, financial autonomy, decision-making and labor force participation. Payments also increase opportunities to access financial services such as savings, credit, remittances and insurance. When both men and women in a household can access payments, women’s participation in household decision-making increases.

To support women’s economic empowerment, a World Bank partnership in Liberia developed a simple financial planning intervention to help couples plan the use of their G2P payment before receiving it. This approach not only increased women’s inclusion but also improved the household’s overall financial condition.

Moving Forward

Digitizing government payments is helping millions of people access assistance more efficiently and securely. With continued investment in inclusive design and digital literacy, this approach has the potential to reach more underserved communities and contribute to long-term poverty reduction.

– Jannah Khalil

Jannah is based in Sacramento, CA, USA and focuses on Good News and Global Health for The Borgen Project.

Photo: Flickr