Creators of Bangla-Pesa Currency Face Prison

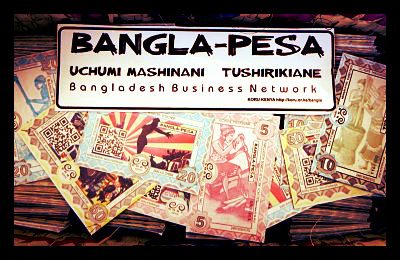

In Kenya, a community currency called the Bangla-Pesa used in a twenty acre slum called Bangladesh was created in order to help reduce poverty. Now, however, the six initial creators of the currency, who are local small business owners and activists, face up to seven years in prison for forgery. Steep penalties for similar practices are not uncommon. In the mid 1700’s in Britain, counterfeiting a Bank of England note was a crime punishable by death. But many are arguing that the Bangla-Pesa cannot be counted as forgery because it in no way resembles Kenya’s currency, the shilling. Today, the Bank of England is still in existence and acknowledges the benefits of complementary currency, but it appears that the Central Bank of Kenya has much to learn.

According to a sociologist at the University of South Maine, printed currencies encourage consumers to shop locally. The website complementarycurrencies.org states that when money stays local for longer, less money needs to be externally funneled back into the community. Complementary currencies also allow for previously undervalued services to be rewarded. The Eco-Pesa, also used for time in Kenya, allowed youths to be paid for collecting trash and resulted in twenty tons of waste being removed from a small town.

Furthermore, because GDP is measured not by goods produced, but by goods and services sold, a nation’s GDP will only increase its people have access to currency. When national financial institutions actively try to keep currency scarce (to flight inflation, for instance) consumer activity often drops, taking the country’s gross domestic product down with it. National tax revenue can also be boosted by community currency, because users of the currency typically still pay whatever taxes apply to their purchase. Thus, by creating a sale where there was no opportunity before, the government’s coffers also benefit.

Despite these new opinions from scholars, the idea of a community creating its own currency to combat poverty is not a new one. Even during the Great Depression, communities across the US printed their own money, and after the recession in 2008, many communities in the United States began printing their own currency at discounted rates to assist those who had been laid off or received reduced wages. Local US currencies include Detroit Cheers, Plenty in New York, and the BerkShare in Massachusetts.

In Brazil, a local currency called the Palmas was also fiercely combated by the Brazilian Central Bank. Its creator was arrested under suspicion of money laundering at an unregistered bank, but a judge later ruled in his favor, arguing that it was a constitutional right for citizens to have access to finance.

William Ruddick, one of the six arrested for the creation of the Bangla-Pesa, said: “These currencies are a solution for alleviating endemic poverty in informal settlements and ensuring that aid money remains in target communities.”

– Samantha Mauney

Sources: Truth Dig, Complementary Currency, Petition, Standard Digital

Photo: Koru Kenya